The latest news and publications from us

The latest news and publications from us

A purpose-driven portfolio to strengthen our community

A purpose-driven portfolio to strengthen our community

Delivering sustainable returns through responsible investment

Delivering sustainable returns through responsible investment

Investment that shapes Brisbane's future

Investment that shapes Brisbane's future

The latest news and publications from us

The latest news and publications from us

A purpose-driven portfolio to strengthen our community

A purpose-driven portfolio to strengthen our community

Delivering sustainable returns through responsible investment

Delivering sustainable returns through responsible investment

Investment that shapes Brisbane's future

Investment that shapes Brisbane's future

Welcome to City of Brisbane Investment Corporation (CBIC)

CBIC is a property investment corporation generating financial returns for the benefit of the people of Brisbane.

CBIC ACHIEVEMENTS

Positive Outcomes for Brisbane

Assets Under Management

Dividends since inception

Total return since inception

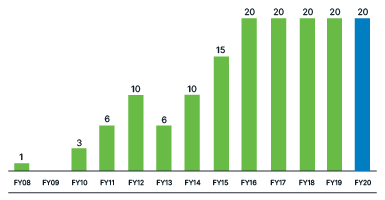

$20

MILLION DIVIDEND

Dividend

Paid $20 million dividend to the shareholder Brisbane City Council for the fifth consecutive year, which will contribute into the Green Future Fund.

$150.7 million dividends paid in total since 2008.

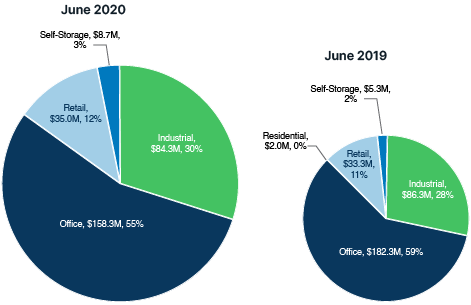

CBIC’s property portfolio favours Australian office and industrial sectors which continue to surpass the performance of the retail and residential sectors.

Our History

CBIC's Journey

2026

Early this financial year, CBIC acquired Bartons Automotive at Wynnum, including a new 10‑year lease and reinvestment opportunities on adjoining land.

2025

CBIC added 48A Radford Road, Reservoir, approx. 13kms from Melbourne CBD. The 5‑year sale and leaseback with a national food manufacturer provides a strategic future infill opportunity.

2024

CBIC acquired 29–47 Mudgee Street, Kingston from Charter Hall for $38.7m ex GST. The 9.6ha site is subject to a long‑term lease with Coates.

2023

33 Allara Street, Canberra was added to the portfolio. The refurbished CBD office has 7 levels, ground-floor retail and basement parking and is occupied by the Commonwealth Government along with major listed and multi-national tenants.

2022

Saw the acquisitions of land at east Brisbane and Everton Park for the delivery of Specialist Disability Accommodation. CBIC saw a $27.62m property valuation uplift in the overall portfolio.

2021

262 Adelaide Street, Brisbane City was sold for $18.8m, contributing to a record profit for CBIC. The project underwent a major refurbishment program, which was completed in 2020, with the asset 100% leased by early 2021.

2020

Sold the South Regional Business Centre for $35.25m and 16 Industrial Avenue, Wacol for $9.5m. This allowed the fund to invest in a wider range of asset classes.

2019

Announcement of Council’s biggest investment in parks and green space, a 5-year program funded by Dividends from CBIC. The program aligned with CBIC’s guiding principles of responsible and ethical investing practices.

2018

Marked its 10-year anniversary. In its first 10-years, CBIC paid out over $110.7m in dividends benefiting Brisbane residents and visitors.

2017

Diversified investment strategy by entering the residential property sector. This new investment strategy, alongside continued interests in the commercial property, led to a $23m profit for the year.

2016

Doubled net assets from $138m to $270m since inception. For the seventh straight year, CBIC’s returns exceeded its long-term investment benchmark, CPI plus 4.5% – 5.5.%.

2015

Acquired three sites for future development in 2016 and 2017. These acquisitions were sought to bring significant long–term returns in the coming financial years.

2014

The acquisition and development of a 7 level office building at O’Connell Tce, Bowen Hills contributed $8.38m to the annual net profit. The acquisition and other asset sales led to a 12.05% annual net return.

2013

First properties sold in operating history totaling approximately $149m. 157 Ann Street, Brisbane sold for $39m and 15 Green Square Close, Fortitude Valley sold for $110m.

2012

The 5 green star and 5 star NABERS rated South Regional Business Centre became operational. The project provided vastly improved facilities for Council staff and local residents.

2011

CBIC invested in its second property asset class with the purchase of Rivergate Shipyard, Murrarie. The property provided a repair and maintenance centre for Council’s CityCats fleet.

2010

CBIC sold its stake in Brisbane Airport Corporation, achieving a $17.8m profit.

2009

Completed negotiation of first major acquisition, a 17 level office building at 157 Ann Street, Brisbane. The site will welcome Brisbane City Council and other tenants in coming years.

2008

Established by Brisbane City Council. CBIC was founded to work alongside Council providing financial returns for Brisbane’s residents and visitors.